Playing a Rigged Game

Who Really Wins in the Financial Markets?

Alfred Yim, Staff Writer

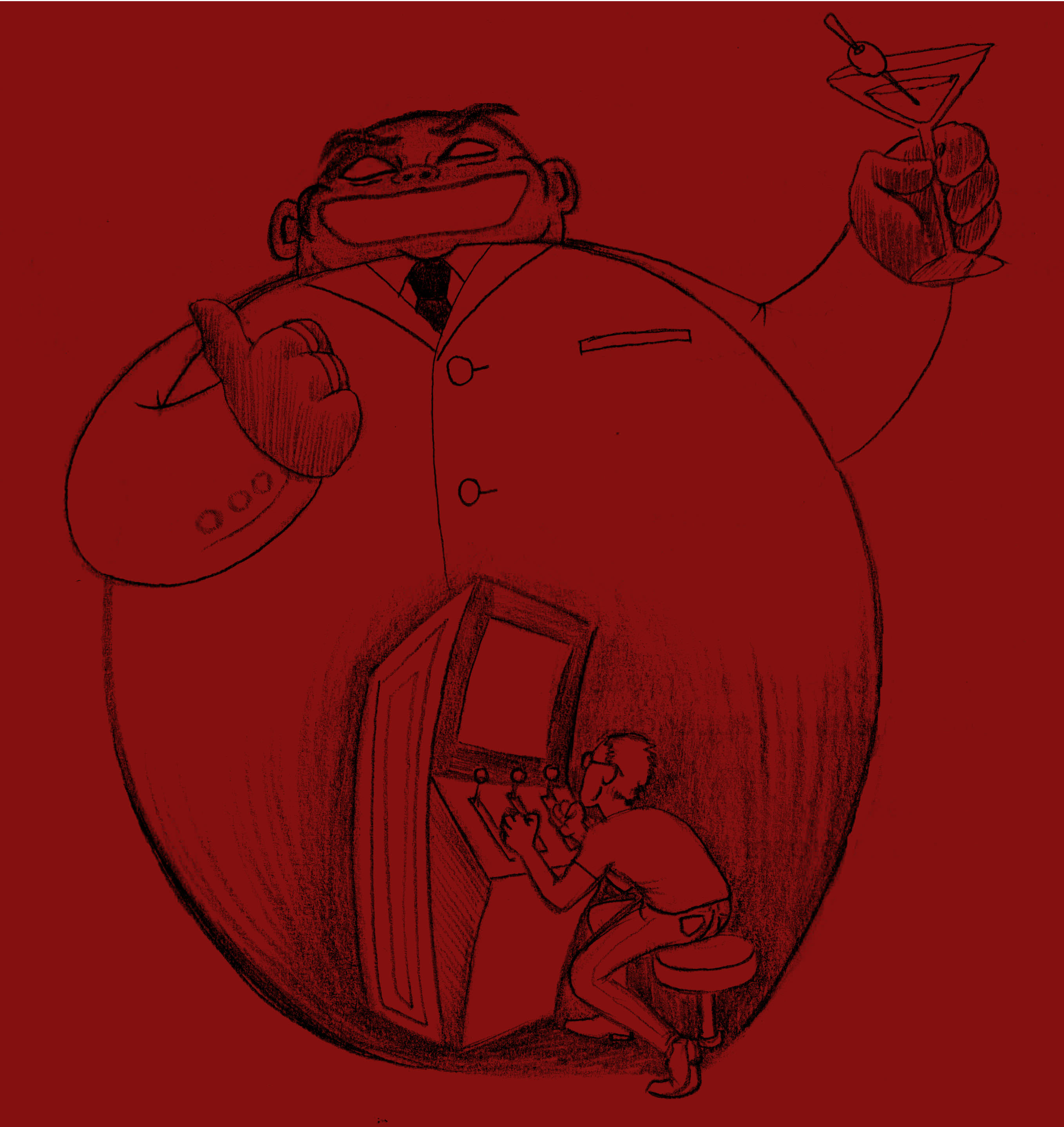

“They can literally materialize their own prosperity and chuckle eerily to themselves on the weekend with a Diamond martini in hand.”

Who makes more money at the casino: the gamblers or the house?

Who makes more money at the casino: the gamblers or the house?

Any competent casino will only allow games where it has a mathematical advantage. The same could be said for the major players in financial markets, also known as the “market makers.” After all, if you’re pushing around billions of dollars, how can you not have a say in which way the market goes?

The idea that regular investors have a significantly lower success rate in trading than their institutional counterparts shouldn’t be outlandish, but just how wide is this fairness gap? In the case of four American banks, JP Morgan Chase, Morgan Stanley, Goldman Sachs and Bank of America, each have beat the market 63 consecutive days in the first quarter of 2010. In fact, on 35 of those days the banks had winnings in excess of 100 million.

On the flipside, some regular investors pretend that they have a 50 percent chance of seeing their stocks rise or decrease in value. By this definition, the probability of achieving the same results as the banks is about the same as the probability of getting away with murder in the American justice system 63 times—it’s just not likely to happen.

If we take this a step further, and assume that these traders at the big banks have a 90% success rate, the chance of doing so for 63 days in a row is only 0.13%. The fact that the banks have made so much money that alternative cigar rolling methods can be explored makes explaining everything away with dumb luck improbable.

[pullquote]They can literally materialize their own prosperity and chuckle eerily to themselves on the weekend with a Diamond martini in hand.[/pullquote]One explanation of how the banks are able to do this is that they were allowed to borrow at nearly 0% interest and lend that same money out at 3% back to the government. This highly exploitable situation is allowed for policy reasons, in that this easy money is an earnest effort by the Federal Reserve to prevent deflation and a depression, and bring confidence back in markets. This free flowing money is also used by banks to trade in futures and other markets.

Low interest rates for banks aside, traders at these banks have the ability to buy large enough volumes of stock and assets to affect prices. They can literally materialize their own prosperity and chuckle eerily to themselves on the weekend with a Diamond martini in hand. That is what happened with the bailout money that came to the hands of banks like Goldman Sachs.

For instance, the Troubled Asset Relief Program money was used by banks to buy up worthless intangible financial assets, particularly those that depended on the ability of people without income to repay loans.

Because of their ability to buy enough of any asset, worthless or not, prices of these worthless assets rose. This allowed profits to be made on things that should be avoided entirely on fundamental reasons.

You, the everyday investor, even after watching many hours of videos describing the financial crisis, would be compelled to join in on the rising price action despite your subconscious screaming epithets at you not to.

In addition, traders at big banks also have the ability to make use of information that regular investors don’t have at their disposal. This is through a practice known as front-running. For example, front-running is essentially what happens when a trader hears about a big purchase about to be placed by a customer. He then uses this information to trade on behalf of the bank before the unfortunate customer, thus enjoying an easy ride up as the customer’s order drives up prices. Although this is unethical and illegal, it can still happen.

When the market makers rig the game and dictate price changes, the free market becomes not so free anymore. If you’re considering investing money on your own, perhaps it’s time you reconsider it.

ARB Team

Arbitrage Magazine

Business News with BITE.

Liked this post? Why not buy the ARB team a beer? Just click an ad or donate below (thank you!)

Liked this article? Hated it? Comment below and share your opinions with other ARB readers!

Share the post "Playing a Rigged Game"