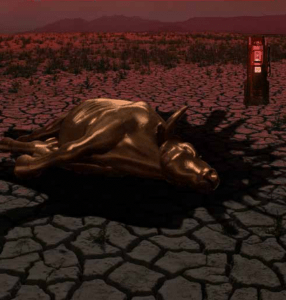

The Age of Energy Scarcity

The Line Is Drawn

Unfortunately, this economic response might be something the world will face sooner rather than later. For as of last December, the IEA placed a fairly definitive date for peak oil at 2020, that is if no new discoveries are made and if oil demand grows on a business-as-usual basis. When asked if this was a sign of some kind, Rubin was quick to reply.

“If you’re familiar with what’s happened with the IEA, you’ll realize that every year the IEA has dramatically reduced its estimates of future world oil supply.”

Rubin then made reference to a Guardian of London exposé (published on Nov. 9th, 2009) that revealed how an IEA official admitted that “many inside the organisation believe that maintaining oil supplies at even 90m to 95m barrels a day (to meet future demand) would be impossible but there are fears that panic could spread on the financial markets if the figures were brought down further. And the Americans fear the end of oil supremacy because it would threaten their power over access to oil resources.”

Out of this admission, it would seem that the world’s ability to maintain low oil prices will soon weaken. A conclusion Rubin shares, as he sees triple-digit oil prices returning sooner than later. His concern however, is the next time oil prices surge into triple-digit territory, whether “the global economy (will) be in any better position to withstand those pressures [the effects of high oil prices] than it was in 2008.”

Rubin explained that “(we’ve already) run up record deficits, particularly in the US, billions and billions have been used to prop up financial institutions. And now that we have those record deficits, what’s going to happen is that the next time triple-digit oil prices hit us, not only will there be no more room to stimulate the economy with further deficits, but we’ll start to have to pay back our current deficits.

“So whereas last time triple-digit oil prices hit, we stepped on the fiscal accelerator by ramping up government spending, (all to) bail out the home owners, bail out the auto companies and bail out the investment banks in New York; this time we’re going have to be raising taxes and cutting back spending and that’s going to be a lot more challenging.”

The Way Forward

From everything Rubin thus far shared, you might be able to see the overall direction he and many other Peak Oil theorists are pointing to: that Peak Oil may actually be Peak GDP. This essentially means that the economy can only grow when oil is plentiful and when it isn’t, our economy, our standard of living we’ve grown accustomed to, will be threatened.

But does it have to be this way? Rubin doesn’t believe so. And that’s the whole message of his book. “ … We can’t stop oil prices from getting back to triple digit levels and, indeed, we won’t be able to stop oil prices from going even above the $147 a barrel … . But what I think we can do, is make sure that when that does happen, it doesn’t necessarily have to have the same kind of devastating impact on our economy and on our lives than it has in our past.

“The key to that is by changing not the nature of what we burn [oil], but changing the nature of the economy. So the single largest thing we can do to immunize the economy from triple digit oil prices is to go from the model of a global economy to a model of a local economy, because a global economy is an extremely energy—and in particular oil intensive—way of doing business.”

So when asked what can be done, Rubin first outlined how he feels the government should both place a price on carbon domestically to encourage local producers to find ways to cut their emissions, while also placing a carbon tariff on those increasingly large carbon emitters, such as China and India.

“One thing is very clear, no matter where you stand on the climate change debate, there cannot be anthropogenic global climate change in this part of the world and not other on the other side. … If there’s global climate change for everybody, there’s no point closing down the Nanticoke coal-fired power plant on the shore of Lake Eerie and making Ontario rate payers payer double or triple for power, while China and India are free to build 800 coal power plants.”

“ … You can’t ask your own producers to pay twice. Once for their own emissions and than to pay again as they lose market share to countries that don’t pay for their emissions.”

Rubin also mentioned the need for massive investments in public infrastructure, particularly in public transit. For when the 40-50 million North American’s are forced to give up their vehicles over the next decade, they’ll at least have a bus or light-rapid-transit vehicle to get on.

“You know, what folks don’t understand is that during WWII, Detroit stopped making cars and practically overnight transformed itself into a munitions factory making tanks and bombers. Well, if Detroit could transform itself into a munitions factory making tanks and bombers in the 1940s, why can’t Detroit and Oshawa today transform themselves and make buses and light-rapid-transit vehicles instead of SUVs?”

But when asked if that is all he thinks can be done, Rubin made sure to point out how he doesn’t view the government as the saviour or solution. Instead, Rubin said, “I see the market as the solution, frankly. When prices get to these levels [three-digit oil prices], we’re going to start making our own steel again; we’re going to start growing our own food; we’re going to start making our own furniture.

“Because it’s no longer going to make any economic sense for us to source our steel and furniture and food from places like China, because the savings that we might get from their labour costs are going to be more than offset by the fuel costs of getting those products to us.

“So the market is going to bring a lot of those jobs back home. The market is going to being a lot of that production back home. Things will certainly cost more money—everything we will make ourselves, or from our regional neighbours, will costs us more than what it used to cost in the world of cheap oil and cheap wages.

“But I think we’re going to find that tomorrow’s economy is going to look a lot different than today’s economy and not all of the changes will be negative.”

Share the post "The Age of Energy Scarcity"