The Evolution of Money

The dominate forms of money in the past, present and future

By Saif Qureshi, Online Co-Editor

Design by: Ryan Trinidad, Art Director

(First published in the Arbitrage Magazine Issue 4)

Money is one of the most important things in our lives. It helps ensure our survival and is a key to power. It is also one of the earliest and most significant inventions by humans and has become the foundation of our modern economies.

Hardly a day goes by without some discussion of money, its promises and its consequences. Almost everything around us has a cost attached to it and obtaining ownership requires money.

Yet, when it comes down to it, we are essentially paying for these goods or services through pieces of paper or through electronic signals (e.g. credit card or online banking).

In fact, we have become so accustomed to these forms of payment that many have never even paused to think about why and how they work. So in order to properly understand the current forms of money we take for granted, it is important to understand how our payment systems have evolved over time … and later, what they may evolve into.

THE DAYS OF WAY BACK WHEN

As surprising as it may seem, money didn’t exist among early human societies. In fact, barter was the first system of payment: an arrangement where two parties agree to exchange one good or service for another, thereby making a transaction.

It is not known exactly when this first started but it is quite possible that it dates back to the first humans. But although this system is very easy to understand and remained dominant for quite some time, there are few to no rules and the rate of exchange is vague.

But from 9000 to 6000 BC, with the advent of new farming techniques, a new form of barter grew in popularity. It became commonplace for farmers to trade commodities, such as cattle or grain, for some other good. This commodity money became an ideal currency because everyone knew what a bushel or cow was worth.

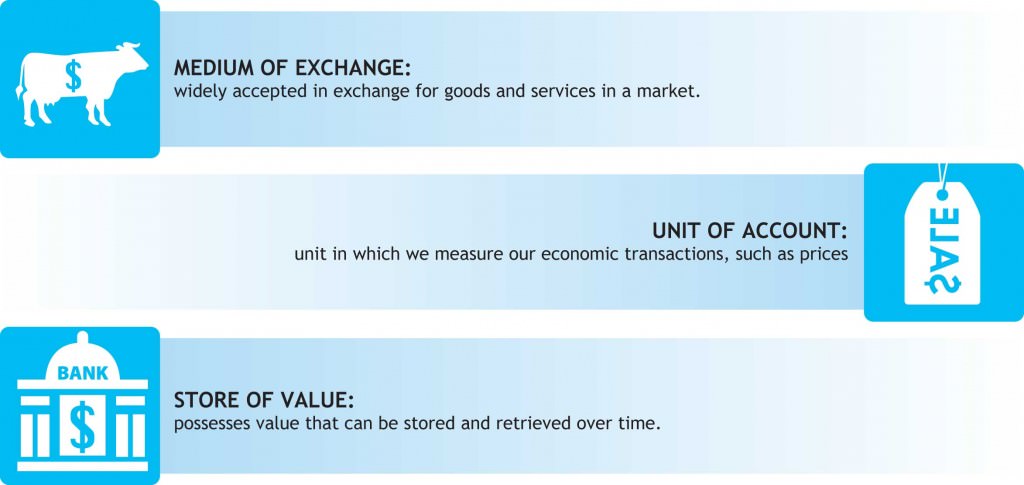

That said, in order for money to be a medium of exchange, it also needs to also be easily transportable and divisible, so that it can become easy to use. This is one reason why cattle are not used today as a form of currency; as it’s very inconvenient to hack a cow into small pieces, keep it refrigerated and bring enough of its carcass to a store to purchase a new shoe.

Considering the three functions shown in the infographic above, the first known primitive form of money was cowrie shells, which came into use around 1200 BC in China. These shells were found around the Maldives and were highly regarded in China and India, due to their attractiveness and rarity.

Similarly, much later on in history, American Indians highly valued wampum shells and used them for decoration, jewellery, religious ceremonies (buried in graves) and of course as money. In fact, these shells were acceptable for payments of debts, fines, tributes and even for ransom. All of these uses for the wampum shells and its symbolic value ensured that their demand and value remained strong.

Around 7th century BC, money evolved once again and started to become familiar to what we have today. In Turkey, bean-shaped currency was produced using gold and silver. These primitive coins had a special mark on them, which represented the coin’s specific value. Previous to this creation, the metal was simply exchanged based on its weight and purity, which made it very difficult to engage in a transaction since both of those qualities had to be measured.

About 100 years later, in the kingdom of Lydia (located in modern day Turkey), circular coins as we know them today were invented. Seeing the benefits of this standardized currency, other nations such as the Persian and Roman empires were quick to follow and further refined their currencies. (Coincidentally, at around the same time, craftsmen in China were making coins with very elaborate shapes such as spades and knives, of which the flat surfaces were decorated with Chinese characters.) It was not until the 3rd century BC that the Roman emperor decided to create a more practical round coin, but with a square hole in the centre.

With the rise of money, different sorts of financial transactions started to take place, which could be called the beginning of banking. In Greece, starting from 4th century BC, private entrepreneurs and institutions (such as temples and public governments) began taking deposits, making loans, exchanging different currencies and testing the coins for weight and purity. Many of these transactions were unheard of since this time and provided the citizens with more services and convenience

ITS JUST PAPER I TELL YOU

Around the 9th century AD, the first official paper currency was introduced in China under the Song dynasty. It was quite different from today’s modern currency though because it was in very short supply, had an expiration date and was only available in some regions. However, the main benefit was that wealthy people did not have to carry a ton of currency around. In fact, the origin of paper currency was that rich merchants who owned lots of coins, started to leave their wealth with a trustworthy person and in turn received a promissory note (representative money), which could be redeemed afterwards.

These occurrences coupled with a shortage of copper, led to the government implementing one of the first forms of fiat money in human history. However, about five hundred years later, this currency was eventually abolished because there was mass printing of bank notes, which led to rising inflation. Notably, this was still several years before the Europeans would adopt paper currency and several centuries before it would become widely used.

Then came Stockholms Banco, a private bank in Sweden founded in 1657 by Johan Palmstruch. Four years after its foundation with the collaboration of the government, it became the first bank to issue European banknotes, which could be exchanged for a specific amount of silver coins at the bank. These banknotes became very popular, as they were easy to carry around (rather than the metal currency of the time) and could be exchanged for goods at the market.

Unfortunately, the bank issued more notes than it could redeem for silver coins and so when people started asking to have their notes honoured, the bank did not have enough reserves. This led to a loss of confidence in paper currency, ending with the Swedish government taking control over the bank, settling debts and quickly thereafter closing it down.

As these two examples show, establishing paper currency was far from easy. For the next few centuries, several attempts were made with banknotes, until eventually they became accepted by the public. The only reason why people did eventually become comfortable with paper (fiat) money that was worth nothing was when governments backed them with their own reserves. This prevented banks like the Stockholms Banco, from becoming bankrupt but introduced a truly new evil to the world: inflation.

To battle this problem, several countries started to adopt the gold standard, which is when countries start to fix their currencies to a set value in gold.

The gold standard reduces inflation because it is very difficult to manipulate the economy’s demand for money when it’s backed up by gold. Specifically, one can only produce as much money as there is gold; but since the world’s gold supply is fixed, the amount of money in the world would remain the same unless one discovers a new gold mine or new method of alchemy.

Unfortunately, this strength was also its eventual undoing, as the gold standard was short lived. During the Great Depression, the system completely collapsed after many economists blamed it for being unable to revive the economy through monetary policy (i.e. increasing the money supply to pump funds into the market, as we saw governments do following the 08-09 economic meltdown).

The new system that followed arose at the end of World War II, where the International Breton Woods System replaced the gold standard. Under this agreement, all countries agreed to tie their currencies to the US dollar, which was pegged at $35 per ounce of gold. This occurred mainly because the US was the world’s largest economic power and because it held the majority of gold reserves.

This system endured until 1971, when the dollar started to devalue and other countries did not want to appreciate (raise) their currency value due to the damage it would do to their export dependant industries. As a result, the United States abandoned the fixed value of the dollar and let it float in the world’s money markets (fiat currency).

This is how the world’s monetary system now works and has become very important in international trade and globalization. Fiat currency, which is used in most of today’s developed countries, is issued by the government as legal tender and is not convertible into anything such as gold or silver; making it virtually useless were it not for its acceptance in transactions (i.e. by society’s willingness to believe that government backed pieces of paper have value).

THE DIGITAL AGE

Just to stop and put this all into perspective: there were many forms of currency not even discussed above because the thousands of small societies in human history each had their own different methods for commerce. However, most of these can be classified as some form of commodity or representative money.

More recently, we have seen a completely new form of money emerge: digital money. The categories within this form of money are broad, including: credit cards, banking, online trading and internet payment systems.

· CREDIT CARDS: When a credit card is swiped, an electronic signal is sent through the card network over phone or cable lines, carrying all that transaction’s information. The benefits from this are that it makes it very easy for consumers to conduct transactions and that there is always an available line of credit.

· BANKING: In regards to banking, computers fit very well in banks, because they are ideal for storing information and performing calculations. Today, they are used in electronic fund transfers between banks, in ATMs and also in online banking, which makes it very convenient to pay your bills.

· ONLINE TRADING: Additionally, digital money has also found its place in the capital markets, since most trading is now done electronically. There are also many online brokerage websites with very low commissions that now allow you to trade stocks.

· INTERNET PAYMENT: The next context in which digital money has become so important is e-commerce. While privacy is always a concern, with internet security growing more secure year by year, online credit card transactions has grown each year over this past decade.

In fact, while the traditional credit card model has held sway for quite some time, with the rise of more advanced computing power and complex programming, the payment system can be made much more efficient and does not need to be such a burden on sellers. Thanks you influential online payment web services like PayPal, the cost of accepting credit card payments have fallen dramatically.

This concludes our version of the history of money. One thing that is clear from all of this is that money in one form or another will probably be around for a long time. Other payment systems that could become dominant in the future and have already started to take shape around the world include payment through mobile airtime, through public transit passes and Twitpay (paying through twitter).

Although we still don’t know what that dominant form of money will be in the future, one thing that’s for certain is that we will continue to spend those precious dollars in a completely different way and as the trend shows, spending will likely become easier.

Arbitrage Magazine

Liked this post? Why not buy the ARB team a beer? Just click an ad or donate below (thank you!)

Share the post "The Evolution of Money"