How M&A is Shaping the Banking Industry

Cons can be found by valuation. Company A must evaluate how much they think Company B is worth. The deal can fail before it even starts if Company A doesn’t understand their target’s business and operations well enough. And if Company A approaches Company B with too low of an offer, it might create hostility. A deal can also fail after the merger with post-integration problems such as conflicting corporate culture, technological differences, and brand dilution.

It’s also a good idea to check the target’s books for misleading assets. Companies must avoid the mistake Bank of America made when they acquired Merrill Lynch. They had saved the failing firm only to find larger-than-expected losses on Merrill’s balance sheet. Executing thorough due diligence lets you know exactly what you’re buying.

Once the target is valued, the deal proceeds in stages. The first stage is buying the target’s stock. The acquirer can purchase up to 5 percent of the target’s stock before they must declare their intentions to the Securities and Exchange Commission. Now that the acquirer has a substantial stake in its target, they can make an initial offer called the tender offer.

Now the ball is in the target’s court. At this stage of the deal, they can do a few things, depending how they feel about the offer. If they approve, the deal can go forward. If they don’t approve, they can try to negotiate a better offer, issue new shares, or find another buyer. By issuing new shares to all existing shareholders (expect the acquirer) at a discount price, the target reduces, or dilutes, the acquirer’s position in their company.

Deals also have to be run past regulators to check if the new company will create a monopoly situation and diminish competition. These scenarios have a great impact on market diversity, and are particularly disadvantageous to consumers because competition leads to better consumer deals.

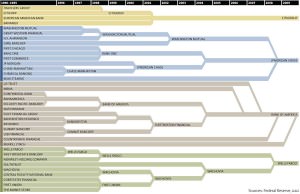

Regulation turned out to be especially important after the financial crisis of 2008. Deals throughout the 1990s and early 2000s gave rise to giant financial institutions that were deemed “too big to fail.” In 2008, banks like Bank of America and Citigroup had to be bailed out by the US government because their failure would have had widespread economic consequences.

Canada did not have these problems thanks partly to the government’s rejection of large bank mergers. In 1998, Bank of Montreal and TD were set to merge with RBC and CIBC, respectively. Paul Martin, the Finance Minister at the time, disallowed this because, among other reasons, it would have drastically reduced competition between Canadian banks and flexibility for customers.

Since 2008, M&A in the financial sector has declined substantially in volume and value because big deals aren’t happening like they used to. PwC reports that deal volume in the banking sector has decreased by 24 percent between 2010 and 2011. Many factors contribute to this decline, including stricter regulations, the European Sovereign debt crisis, and volatility in the markets.

So where does banking M&A look like it’s heading in the next few years? That depends on which banks you’re looking at.

Reports by both Merrill DataSite and Deloitte suggest that M&A activity is going to increase in small and mid-size institutions as they try to keep up with rising regulatory requirements. At their current size, smaller banks do not have enough capital to viably deal with increased operational costs and capital requirements. The reports also indicate that these increases, along with improved credit quality, will greatly encourage deal-making amongst smaller banks.

M&A activity between larger banks, on the other hand, is expected to decrease. Gordon Nixon, CEO of RBC, stated that because of strict requirements on reserve capital, the massive deals between banks that predate the financial crisis of 2008 are in the past. Big banks are now looking for ways to “fill in some of the holes that [the banks] have in some of [their] global platforms.” In fact, RBC is in the process of expanding its global wealth management business, which has been one of its ”holes.”

“That may sound less exciting than what you might have seen from 2000 to 2008, where you saw much bolder and more aggressive transactions,” said Mr. Nixon, “but clearly in today’s environment that’s not going to be something I think you’re going to see in the future.”

Indeed, others agree with Mr. Nixon’s outlook regarding the effect of regulations. Ivan Lehon and Omar Mizra at Ernest and Young Capital Advisors point out that the Dodd-Frank Act and Basel III are two regulations with the most influence on M&A activity in the United States.

Share the post "How M&A is Shaping the Banking Industry"