How to be a Successful Forex Trader?

On our example chart, there are two annotated patterns a ‘Triangle’ and a ‘Flag’ consolidation pattern. Both are good formations—when the price leaves the patterns on the positive or negative side (called a Breakout) it usually signals a strong move in that direction.

As a general rule, you should get familiar with only a few patterns at once. In fact, a lot of successful traders only trade one pattern that they know the best. If you practice, you will get a feel for the pattern; you will know intuitively that a breakout will be tradable or not!

With these simple strategies, you can start trading and practice the basics!

Let’s see how to manage exactly your positions!

Risk and management

Stop-loss

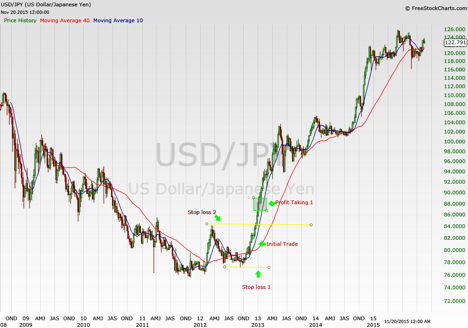

One of the key principles of trading is that you should always limit your losses and let your profitable positions run. When you enter a trade, you should have a plan in place how to exit that position. If your position reaches a pre-defined amount of loss, you should exit the position.

This is called the stop-loss order, and it is the basis of risk management in forex trading. The good thing is that this process can be done automatically by your broker at the time you initially trade. You just have to decide where to place the stop-loss order.

Profit-taking

When you have a profitable trade, you should also manage that position. If the currency pair reaches a sensible profit target, usually based on technical analysis, the best thing is to cash-in on at least some of the profits. If the price is in a good trend, you can leave a portion of your position open and place a new stop-loss order higher than the original one.

If you take a look at the example below it will be very easy to understand the concept. And you’re your position goes further into positive you can always follow it with a new stop loss—protecting your profits.

Remember investing? By using these simple rules, you can turn a trading position into a long-term investment—a strong trend can last for years in the forex market.

Money management

Now you know the basics of risk management, but you might ask the question: How big positions should I take?

There is no one good answer to that question; the crucial thing is that it should be in line with your trading style. Some people like to concentrate on one pair while others might have positions in several different pairs.

The important thing is that your overall risk should be controlled. If you have just one position, it may be much bigger than the multiple positions of someone else.

This process of adjusting your position sizing to your amount of capital is called Money Management, and this is maybe the most common difference between successful and losing traders. Why? Because if you don’t manage your positions one trade can ruin months of profitable investments!

Always plan your trades and manage risk!

Choosing a forex broker

To trade, you will have to open an account at an online forex broker who has access to the market. There are hundreds of brokers out there so you should wisely. There are many factors to consider; here is a list of the most crucial ones:

Reputation, history of the company

If you will trust a broker with your money you should be sure that the firm you deal with is a reputable and reliable one. Check the history of broker the longer it dates back, the better as they have probably lived through difficult markets and proved stable. You should also check the reviews left by previous users, current users, and independent third parties about the services of the broker.

Share the post "How to be a Successful Forex Trader?"