Forecasting Recessions: the Anxious Index

“So where can we turn to for a reasonably accurate predictor of an economic downturn? The answer may lie in something that sounds altogether sinister: the Anxious Index.”

A useful tool to calculate the beginning and the end of recessions for productive analysis

by Pawan J. Shamdasani

Design by Jeff Fritz

(First published in the Arbitrage Magazine Issue 2)

Over the past two decades, Wall-Street economists have failed to predict any of the three recessions that have damaged the economy. Thus, one might ask—given the sheer amount of top talent the financial industry payrolls—is this failure due to incompetence or is it … by design?

For an economist, forecasting a recession (what a Bloomberg poll describes as two back-to-back quarters of contraction) would mean diminishing profits for their companies and huge reductions in their paycheck, as investor confidence and the likelihood to purchase stocks plummets. Thus, a trade-off exists between making accurate and upbeat forecasts for the simple fact that these economists have an incentive to predict more growth in a time when a recession is most imminent.

for a reasonably accurate predictor

of an economic downturn?

The answer may lie in something that sounds altogether sinister:

the Anxious Index.

The Anxious Index (first christened in 2002, by New York Times reporter, David Leonhardt) is a commonly used economic tool to estimate the start and end of a recession. It is solely based on data from the Survey of Professional Forecasters: a quarterly survey of US economic forecasts conducted by the Federal Reserve Bank of Philadelphia (“Philadelphia Fed”) since 1990. From 1968 to 1989, the American Statistical Association and the National Bureau of Economic Research were held responsible for the survey. To create it, a variety of forecasters are surveyed, including Wall Street economists, corporate economists, independent economists and academics. Yet, what makes this survey most beneficial is that the forecasts are anonymous.

Why is this diversity and anonymity crucial? It’s because of the conflict of interest mentioned earlier. The index takes this limitation into account, thus making it a reliable estimator.

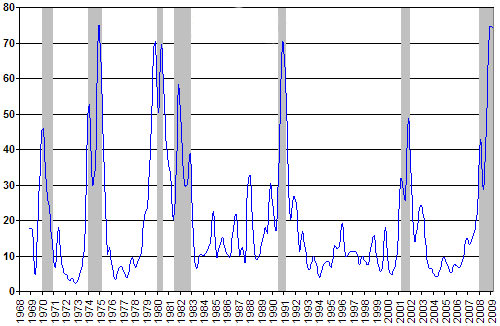

To be precise, the anxious index is a measure of “the probability of a decline in real GDP in the quarter after a survey is taken. For example, in the survey taken in the third quarter of 2009, the anxious index is 23.7 percent, which means that forecasters believe there is a 23.7 percent chance that real GDP will decline in the fourth quarter of 2009” (phil.frb.org).

Economists are specifically asked to predict the chance that GDP will fall in the current quarter and in the four quarters subsequent to that period. An anxious index number of 30 or more is usually a clear indication that GDP will decline in the following quarter and continue to decline considerably further on, suggesting a high possibility of a recession. An index number of 10 implies a relatively stable economic environment but when comparing the forecasts over a few quarters, the index has jumped quickly and even tripled in some cases, before most people realise that a recession has kicked in.

Sourced from the Federal Reserve Bank of Philadelphia. Note how the spikes tend to match those years when recessions happened … .

“When we’re up in that range, it really means a recession could happen at any time,” said Dean Croushore, an economist at the Philadelphia Fed.

Since 1968, the anxious index has generally risen above 30 before every recession. However, the index is not perfect; after all, it’s still an estimate. There have been moments after recessions ended where the index has risen above 30. An example includes the 1987 stock market crash where the index was seen to be above 30 following it and did not precede into another recession. Studies by the Philadelphia Fed also suggest that the accuracy of the index diminishes significantly after one quarter when a survey is taken. This happens for two reasons:

(1) inputs to the forecast are based on flawed assumptions since professional forecasters use yield curves in their forecasts and

(2) the survey, which began in 1968, does not include forecasts during the Great Depression, which are more relevant to the current economy.

In spite of this, the anxious index is a more accurate and reliable warning for recessions than individual economists’ forecasts, which are deemed by most industry professionals to be poor estimators of future economic activity. The index has been accurate in forecasting recessions one quarter ahead and historically, a number of 40 and above has been a good indication that a recession has already started. The most recent case was in the first quarter of 2008 when the index was 42.9.

During the first quarter of 2009, the anxious index was at its peak of 74. Since then, there has been a downward trend in the index from 46.5 in the second quarter to 23.7 in the third quarter. So, at present, the number is around 24. Based on the figures, can we conclude whether the recession is over? Probably not! However, what can be said is that we are still facing a severe recession. How long will the economy take to recover? Only time can tell.

Arbitrage Magazine

Liked this post? Why not buy the ARB team a beer? Just click an ad or

Share the post "Forecasting Recessions: the Anxious Index"