Is the Financial System One Giant Pyramid Scheme?

“To be blunt, what if our entire financial system—as it exists today—is a scam, one that’s hardwired to funnel wealth from the masses to an elite few?”

All the world is a cage today, but how can we avoid it tomorrow?

OPINION ARTICLE

David Tal, Staff Writer

Jennifer Lee, Designer

(First published in the Arbitrage Magazine Issue 4)

“I’m careful,” most think. “I know enough not to get mixed up in these things.”

These are the lullabies people say to comfort themselves. However, as you’ll see, it’s no defence.

Take the case of Bernard “Bernie” L. Madoff. He got caught inside a whirlpool last March, 2009, when he pled guilty to running an elaborate Ponzi scheme that fooled a highlight reel of celebrities, charitable organizations and what many considered to be ‘informed/professional’ investors. The fallout was many tens of billions worth of investments written off into the red—this included the life-savings of many who will now never know a comfortable retirement.

When such high profile scams make headlines, both the victims and the public are left to ask how so many high-powered, intelligent people could be duped so easily. In retrospect, it seems obvious that an eye of caution be directed upon people or corporations who offer inexplicably high or consistent returns on monies invested.

Haven’t these people ever heard the adage that if something sounds too good to be true, it usually is? Such questions generally conclude with people mumbling another adage—buyer beware—and then believing that the same thing could never happen to them.

But what if it can?

What if you, dear reader, are already in the clutches of a similar scam to the one suffered by Madoff’s investors? And what if everyone is in on it, both as victims and perpetrators of the largest financial scam known to human history?

To be more blunt, what if our entire financial system—as it exists today—is a scam, one that’s hardwired to funnel wealth from the masses to an elite few?

Don’t want to believe it?

Well, before you stop reading, how about we play around with this theory?

To start, if we are going to put our financial system on trial, we’ve got to understand how it really works.

SET UP

For one, how should we define our present financial system?

Well, we can start by focusing on the financial system that the modern world’s majority uses: Monetarism. This is a theory whereby, according to the American Heritage Dictionary, “economic variations within a given system, such as changing rates of inflation, are most often caused by increases or decreases in the money supply—usually enacted by controlled government policy.” (For those new to economics, don’t worry. This will be explained more simply soon enough.)

No matter the country, nor the dominant ideology we ascribe to—be it communist, socialist or capitalist—they all use a monetary system; only the degree of government intervention in the system varies.

Next, what kind of scam are we charging our financial system of resembling? For the purposes of this article, we will use a pyramid scheme as a model (albeit the most sophisticated pyramid scheme ever devised).

[pullquote]One should also consider that it often isn’t a shifty looking man in a trench coat trying to recruit you into these get-rich-quick-schemes, but normal, honest-looking people.[/pullquote]

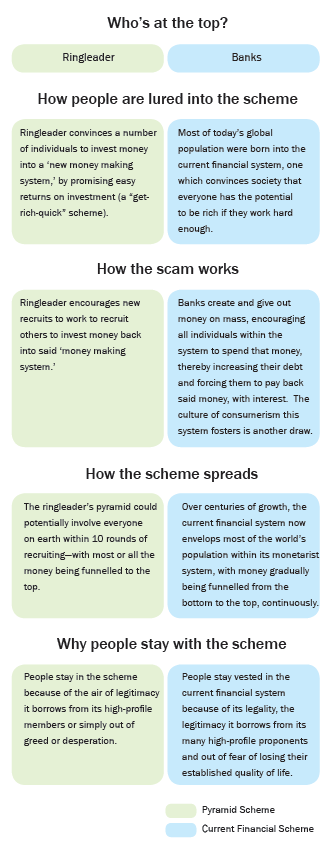

Briefly, a pyramid scheme is a scam where one ringleader (sometimes a team) convinces a number of individuals to invest money into a ‘new money making system,’ which requires these new investors to work—usually on a kind of commission—to recruit others to then invest money back into the said ‘system.’ Those new recruits are then encouraged to lure even more individuals into this system and so on.

This scheme is called a pyramid scheme because of its shape: if one person recruits ten people and those ten each recruit ten others and so on, the pyramid could potentially involve everyone on earth within ten rounds of recruiting—with most or all the money being funnelled to the top.

That said, such schemes never make it to this level, as once it reaches a certain size, there will always be a few who begin to smell a fish.

So with these parameters set, let’s turn our attention to some of the biggest reasons why people get caught up in financial schemes. According to Skepdic.com, greed is probably the underlying factor. The desire for wealth and power are easy levers the crafty can use against most anybody.

This greed, or even just a basic desperation for money, can lead to varying states of wishful thinking, where even the smartest of those involved throw away logic and reason for the hope that this ‘money-making system’ is actually legitimate. As a result, asking those worthwhile questions that can save one’s wallet all of a sudden begins to feel uncomfortable or impolite.

Even those few who catch on to what they’ve gotten themselves into continue playing along, thinking, “Hey, I’m not at the bottom of the pyramid; I’m near the top. I can still get out of this making a profit!” Housing Meltdown, anyone?

Finally, one should also consider that it often isn’t a shifty looking man in a trench coat trying to recruit you into these get-rich-quick-schemes, but normal, honest-looking people. These people are quite often educated and/or well-respected, like teachers, investors (ala Bernie) and even police officers. Anyone is susceptible, and the more the initial ringmaster can attract respected participates into this system, the more it wraps around itself an air of legitimacy borrowed from such individuals. This makes the system that much more attractive to future recruits.

FOUNDATION

Now that we’ve explored how average financial schemes scam people, it’s about time we investigate our present financial system to see how it scams people in a positively above-average way. To do this, we first need to explore the system’s innards, i.e. shed light on how money is created, how it’s manipulated, and how you and I and all of society are bound inside its cage.

To begin, let’s show how money is created.

*The new money created is created out of debt, i.e. the Central Bank created the 10 billion with the expectation that it will all be paid back. So essentially, MONEY = DEBT. [In fact, under our current system, one cannot exist without the other. If everyone paid off all their debt, there would be no money for the economy to function. The crazy thing is, the world doesn’t even have enough money to pay off all the debt that exists (sidebar B will answer why this is so).]

*Once the 10 billion is deposited into a bank, that bank can then lend out that money. The only limit being said bank needs to keep a percentage of the original deposit on hold as a “reserve” (usually around 10%); e.g. out of the 10 billion deposited, the bank can now lend out 9 billion. [This process is referred to as “Fractional Reserve Banking.”]

*However, while logic would have you think that banks lend out that 9 billion from the original 10 billion, the truth is that 9 billion is lent ON TOP of that original 10 billion. That’s right, 9 billion in brand new money is created into the economy simply because there is a demand for this loan and there is enough money in the bank to fulfil the reserve requirements. So basically, after the bank asks you for assets (e.g. your car) to back up your mortgage, the bank in turn creates and lends you money from nothing, money that’s backed up by nothing except a hypothetical liability: money that you’re expected to pay back and then some.

*The implications of this are huge, as this process will happen all over again in the bank where that 9 billion is next deposited (minus the 10% reserve) and again in the next bank and the next, etc.

*If this process runs its course, that initial 10 billion the Federal government called into existence has the potential to add another 90 billion into the economic system. All of this is money created out of nothing.

*But if the money came from nothing, where does it get its value? The only place it can: from the existing money supply. The new money steals value from the existing money supply, expanding the money supply irrespective of the demand, thus reducing its worth and creating inflation. This means that our Fractional Reserve System is inherently inflationary, thus reducing the buying power of our money (see chart below).

*This inflation acts as a built in tax upon society and is a built in trait of our financial system.

Now that we know how money is created, let’s take it one step further. Aside from the inflation that’s structurally built into our financial system (thanks to the Fractional Reserve System), there is another factor, one that makes this system thoroughly unstable and perpetually in need of government intervention—like a crack fiend’s constant search for another fix.

Interest.

Sometimes called usury, interest (the charging of a fee for the use of money) was once banned in the ancient world. All Abrahamic belief systems (i.e. Judaism, Christianity & Islam) likened it to a sin and even philosophical titans like Aristotle deemed it unnatural. It was only until late into the 16th century that interest slowly began to gain acceptance (primarily due to a push from the business classes), until charging interest became normalized in the 17th century.

Now while the concerns about interest being sinful may be a tad antiquated, the way it affects and distorts our financial system, our personal lives and our freedoms are very real.

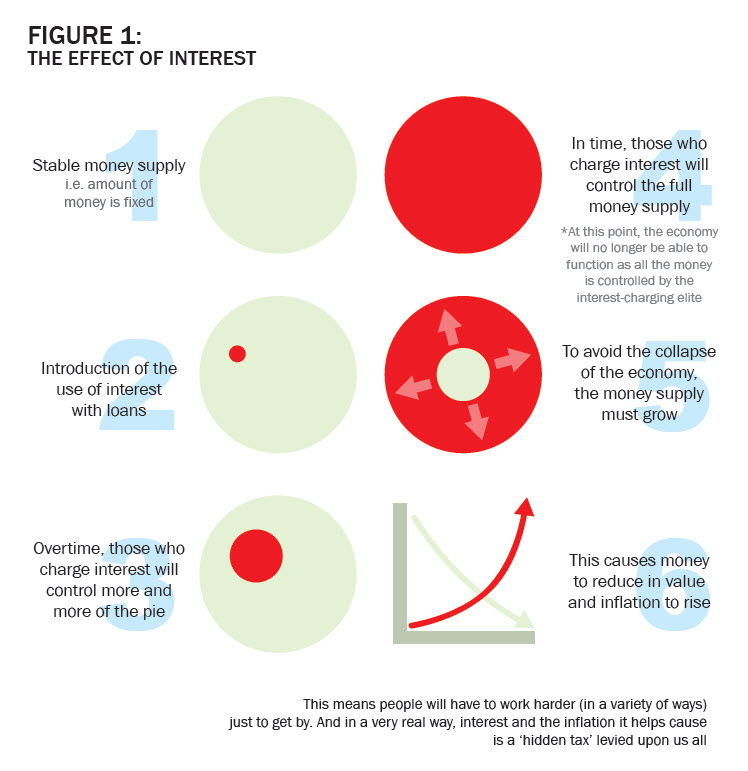

To explain, think back to the previous sidebar that explained how money is created and now add on top of it the next sidebar that explains the effect of interest.

From what The Effect of Interest infographic* shows us, interest has no place in a perfectly stable and sustainable monetary system, as its presence is an inherently destabilizing influence that works to undermine the viability of a stable economic system.

This is because not only is new money generated out of nothing (ala sidebar A), but the money needed to pay back the interest applied to this new money doesn’t even exist!

So where does society find all this non-existent money to pay down the interest on the money that was created out of nothing?

It can’t.

The system in place now has a built-in perpetual deficit, one that is destined to collapse the entire system unless measures are taken to avoid it.

As luck would have it though, there are two options to deal with this flaw. Individually, those who don’t have the power to print more money and can’t pay their debts or interest can simply go bankrupt and have their assets liquidated. Meanwhile, governments, which can print more money, do so, and do so excessively (as we saw governments do following the late 2008 Housing Meltdown).

Thus, on a micro level, the ill effect of both fractional-reserve banking and interest is that a percentage of the population is destined for financial disaster. Meanwhile, on a macro level, the expansion of the money supply, leads to a reduction in buying power (i.e. structurally built-in inflation) and as already mentioned, a hidden and ever-growing tax upon all society in the form of inflation.

A CAGE UNMASKED

On one hand we have a structurally flawed financial system and on the other, we have a pyramid scheme. How do the two relate?

To start, we must ask, “Who’s at the top of this pyramid?”

The simple answer is: those who control the world’s banks (especially the privately owned central banks, like the US Fed) and thus have the power to print money. Now, before this writer enters the realm of conspiracy theory, let me add an extra dimension to this answer: that unlike your average pyramid scheme, there’s actually no one person or group at the top.

People come and go, just as fortunes come and go. Instead, what you’ll see at the pyramid’s precipice is a system, one that promotes profit maximization above all other values. This single-minded drive is what the majority of global society has bought into and what the majority refuses to give up.

Why?

Because we all want to be at the top of that pyramid.

That’s the genius of this system. There is no one individual to point our fingers at because, at the end of the day, we’d only be pointing fingers at ourselves.

Until we, as a collective society, choose not to live under a system where power through the accumulation of money is the core value—a system where greed and corruption aren’t built in—we will forever be beholden to a system where only a small minority at the top prosper and the mass at the bottom struggle or go without.

But some may counter, “Okay, there might be people who let themselves be leashed by greed, but what about the rest of us? How can one system, or pyramid scheme, actually control the majority of the planet’s population?

[pullquote]“One thing to realize about our fractional reserve banking system is that, like a child’s game of musical chairs, as long as the music is playing, there are no losers.”

Andrew Gause, Monetary Historian[/pullquote]

The answer lies in how money is created and the existence of interest (both previously discussed). Essentially, this pyramid scheme creates money through banks that it gives out on mass, encouraging all individuals within the monetarist system to spend that money, thereby increasing their debt and forcing them to pay back said money, with interest or through various forms of bankruptcy.

For the minority of the world’s population who can pay these debts and remain debt free, this arrangement is of no consequence. But for the gross majority, those who can’t pay off 100% their debts by the month’s end or are living paycheque to paycheque, this system ensures a subtle form of veiled servitude—what some might call slavery.

If you don’t work, you won’t be able to pay your debts. If you can’t pay your debts, you won’t be able to keep your possessions and the standard of living to which you’ve grown accustomed. This fear of losing everything is what keeps the world in toe and what ensures the wealth of the bottom continues to flow upward to the banks and those who control them.

So let’s recap:

At this point, a final question begs answering: “If the financial system is just another fancy pyramid scheme, then why hasn’t it failed like all other pyramid schemes?”

The simple reason is that, for centuries, this scheme worked.

Yes, the system is far from balanced and the gap between rich and poor is large and growing everyday, but for all its flaws, the monetarist system of playing to people’s self-interest (greed and the pursuit of power) has resulted in a world far richer and better off today than in any time in human history.

THE RED PILL

But here’s the catch. While it’s true our monetarist system has provided humanity unprecedented wealth, it is also true that it was bankrolled almost entirely by our largest and oldest benefactor: the Earth.

To be clear, in order for the economy to continue growing, in order for it to avoid collapsing under the money supply’s constant expansion, more and more economic resources need to be mined from the earth, processed by man and commercialized by our markets.

Doing this produces enough new wealth fast enough to pay down all those new, interest-laden loans the banks are generally all too happy to give. It’s also what has allowed the human population to grow as much as it has, providing ever-growing numbers of new consumers for the system to exploit and grow.

In all, the flow of resources ensures the music continues to play.

So there you have it:

Debt + Interest + Inflation + ever increasing amounts of raw material and a growing population = the Superstructure of the Invisible Pyramid Scheme every member of society lives under.

It’s no different than what happens to a caribou herd when they discover a new land, one rich in food: they feed, multiply and prosper.

So too with humans.

When we learned the art of agriculture, it allowed us to produce an excess of food from the Earth’s soil and in turn, allowed us to shed off our nomadic lifestyle and commit to and develop communal living (i.e. families, villages, townships, cities, countries). Millennia later, humanity discovered how to harness energy from coal, leading to the first Industrial Revolution. A century later, humanity learned how to harness energy from oil and so the modern age began.

With each new discovery of how to use the Earth’s abundant resources, humanity fed, multiplied and prospered to new heights.

In fact, from the discovery of agriculture (approx. 8000 BC) to the Industrial Revolution (approx. 1800s), global human population gradually grew to around 800 million. Then within only 100 years after the Industrial Revolution, the population grew to one billion. Then after learning to truly harness oil, the most abundant and versatile energy source humanity ever discovered, global population exploded to roughly 6.3 billion and counting.

[pullquote]“Anyone who believes exponential growth can go on forever in a finite world is either a madman or an economist.”

Kenneth Boulding, Economist & founder of the Evolutionary Economics Movement[/pullquote]

Sad thing is, when the caribou herd grows to a point where they exhaust their land’s richness, the prosperity ends. Swaths of caribou starve and the herd shrinks back down to a level the land (Earth) can support. The herd may try and search for a new, richer land, but in the end, the cycle always repeat itself.

And again, so too with humans.

Soon, a time will come when events transpire to alter the very nature of modern society and “the system” as we know it. For pyramid schemes only continue expanding so long as there are more recruits and more money (resources) to pull into its sphere of influence. In other words, such scams can only continue existing in a world of infinite growth.

Sadly, that’s not the world we live in.

While modern economics and society in general choose to assume otherwise, the reality is that we live inside a finite world, a world with limits, both on the number of human beings it can support and the amount of resources it has available for consumption.

Eventually, something’s gotta give. And that something’s going to give within our lifetimes.

CRYSTAL BALL

So how exactly will an economic system that survived for centuries and has seduced the world’s majority into its tentacles’ embrace suddenly fail?

Answer: there are two trends slowly converging into one chaotic mess: resource scarcity and demographics.

The first trend, resource scarcity, was discussed in detail in the previous issue of the Arbitrage (Winter 2010) and so I won’t go into the specifics here.

But to put the matter into perspective, we can think of the Malthusian trap (the theory that the human population growth rate will outpace humanity’s ability to farm enough food to feed this growth). For many decades, the world avoided mass Malthusian starvation because we’ve consistently developed new agriculture technologies to grow higher yields of food. Similarly, the world economy continues to grow because we too freely and cheaply reap from the Earth untold amounts of raw materials that we then turn into riches.

But how much longer can this go on?

Outlined in the Arbitrage’s previous issue, the reality of a finite world is that it will run out of many of its non-renewable resources (especially oil) within the next 50 years or so. And over the next decade, we will begin to see the effects of this growing scarcity in the form of increased prices (inflation) on just about everything we buy.

Meanwhile, when talking about demographics (the subject of the Arbitrage’s next issue), the well known, Comte adage holds true: demographics is destiny.

Economists have few ideas about how to maintain a country’s economic growth if its population is in decline. Remember, our present financial system is predicated on infinite upward growth in resources and population. So without either, the columns of the system begin to crack.

Presently, the birth rates for much of the developed world average out to 0.1%, far below the 2.1% needed for a population to replenish itself (sourced from the Population Reference Bureau’s 2006 World Population Data Sheet).

Roughly speaking, with less people, the labour force shrinks, leading to higher wages whose cost is past on to the consumer; this inflation leads to reduced demand, cut backs in the private sector, layoffs and may lead into a downward recessionary cycle.

Likewise on the government side: a country’s tax base shrinks, causing a nasty chain reaction that weakens its ability to pay for pension plans and public services. This leads to across the board government sending cuts, meaning greater unemployment and increased employment insurance costs that the government won’t be able to afford. This will then lead to the government continually turning to the central bank for loans to pay for needed public services, and in time, once a country reaches the point where it’s borrowing to pay down debts of borrowed money, that’s one step away from a country going bankrupt.

There are no crystal balls, but the fact remains that these two trends are real, well documented, and their effects are generally easy to predict: a gradual reduction in economic and population growth and a possible breakdown in the current financial system’s ability to continue functioning.

ALTERNATIVES?

Given what we know, in order for the world to avert catastrophe, we must shift to a financial system that doesn’t depend on constant growth to function. We need a new, stable, and resilient system. One that can both efficiently manage the world’s growing resource scarcity, while thriving amongst a steadily declining population.

In all, we need something radical enough to save us, but familiar enough to be accepted by a world population that may become increasingly sceptical and fearful of change.

From this writer’s perspective, there are two core options/directions a future financial system may evolve towards in order to meet the challenges of tomorrow. In order of least to most disruptive and familiar, these options include: a financial system influenced by Demurrage (using a kind of Scrip currency) and a Resource Based Economy.

Unfortunately, detailing how each may work will each take an article unto themselves. That’s why two further articles will be published in future Arbitrage issues that will comprise a series exploring the different alternatives our flawed financial system may evolve into and how each may change the world and how we will live in it.

Such a change may seem impossible now. To imagine a world where a whole other financial system takes over, one entirely different from what has claimed dominance for so many generations, certainly seems inconceivable. But as every historian can tell you, what seems impossible today may just become the commonplace reality of tomorrow.

100 years ago, who knew that man would be able to fly and then land on the moon? In our generation, who knew that computers and the Internet would revolutionize nearly every dimension of human existence?

And so too with our financial system.

Nothing is meant to last forever. In the end, a revolution happens roughly every quarter century in some form or another— and we’re about due for the next one. So when it happens, don’t be surprised if it changes everything.

ARB Team

Arbitrage Magazine

Business News with BITE

Liked this post? Why not buy the ARB team a beer? Just click an ad or

Share the post "Is the Financial System One Giant Pyramid Scheme?"