How to be a Successful Forex Trader?

Have you heard about Forex? Do you think you have what it takes to be a trader? No? Well, I have good news; everyone can be a successful trader!

You just have to follow some basic rules and get informed about the market so you won’t make the mistakes that some beginners do. Also, you have to select the strategies and the trading styles that suit your personality. It doesn’t matter whether you are trading stocks, forex, precious metals, futures, or, live binary options, these tips can help you to build a successful career as a trader. This article helps you take the first steps, choose your broker, and describe all the important rules to keep in order to be successful.

Let’s begin with the basics of the forex market!

The basics

Forex stands for foreign exchange, basically the different currencies of the world. The center of the market is the US Dollar as the general reserve currency for most nations. Usually, currencies are measured regarding dollars, and some the most important currency pairs are the ones with the USD in them.

A currency pair is the ratio of two currencies, for example, the EUR/USD; the ratio of the Euro and the US Dollar. This currency pair, actually the most traded one of all pairs, now stands at around 1.07. That means one Euro buys 1.07 dollars.

EUR/USD chart: An Example of Opportunities in the Forex Market

Not long ago, in June 2014, this ratio was 1.4. That is a huge (25%) move in the world of currencies, and these are the kinds of moves that make Forex very attractive for traders. In this market, you can make multiple times the amount of the moves of currency pairs as I will explain to you later in detail.

Some terms you need to know

Pip, big figure

This is the basis of every move in the forex universe. It means the fifth digit of the ratio—for example, the 5 in the 1.0715. A hundred pips are called one big figure, and that term is also commonly used to describe larger changes in currency pairs.

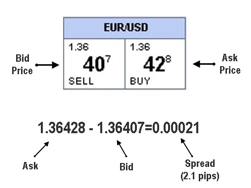

Bid, Ask, Spread

The difference between the two is called the spread—that is the ‘price’ you pay for your trade. The narrower the spread, the better it is for traders. When you choose a broker, as an active trader, this should be one of the first things to check.

Long and short positions

As a forex pair constitutes of two currencies betting on one of those means that it strengthens compared to the other one. Depending on which currency do you think will go you can be long or short a pair. Being long means that you bet on the ratio to rise and to be short means that you think it will fall.

Taking the EUR/USD as an example again, if you are long the pair you are betting on the Euro rising against the Dollar. Being short this pair is a bet on the Dollar against the Euro.

Investing or active trading

There is sometimes a huge distinction between investing and trading in financial markets. Investors usually hold positions for a long-term while traders focus on short-term profits.

This guide focuses on active trading, but that doesn’t mean you can’t hold the positions for long-term as an investment. On the contrary with proper risk management, a well-planned trading position can turn into an even better investment.

Would you like to have the best of both worlds?

Read on!

What drives forex markets?

To put it simply the fate of a forex pair is determined by the supply and demand of the currencies in the pair.

The demand depends on a lot of factors, but there are two that are the most important. The first is the performance of the economy behind the currency, the US economy for the Dollar as an example—the better the economy, the higher the demand for the currency. The second is the interest rate set by the central bank of the given country—the higher the interest rate, the higher the demand.

The supply is simple; in today’s world central banks decide the available amount of currencies. And as with everything the more there is of something the less valuable it is. So when you here that a country is printing more money you can be sure they want their currency to be cheaper.

If you pay attention to news and trends, you might be able to forecast the primary direction of currency trends.

But there is another huge factor that I haven’t mentioned the psychology of traders and the effect that has on prices. That’s where technical analysis comes in!

Technical Analysis

Technical analysis (TA) is the study of the price history of any financial market and the prediction of prices based on that. The theory behind TA is that people in crowds tend to react similarly in situations that are alike and that prices move in trends.

In practice, that means that following a particular type of price movements (chart pattern) the following movements will also be similar.

Trends mean that there are long-term movements in prices based upon changes in the factors behind supply and demand.

For you, the only thing to remember is to look for trends and reliable chart patterns and use them in your trading!

Trend Basics and Examples of Chart Patterns

To get you started, let’s look at some examples of both chart patterns and trend measures. There are lots of methods to analyze prices, but all of them are based on some tables that represent the price history of a forex pair.

Charting is the process of identifying (and drawing) trends, patterns and using various indicators to analyze the behavior of the given market.

Moving Averages

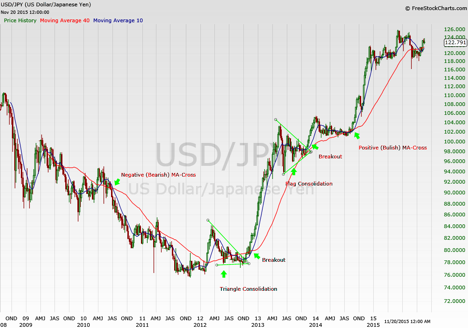

Probably the best-known indicators are Moving Averages that capture both short and long-term trends in a price. Looking at the example weekly chart of the USD/JPY (Dollar/ Japanese Yen), there are two (the ‘quick’ average: 50-week MA and the ‘slow’ average: 200-week MA, blue and red lines respectively) moving averages on it.

One way to look at these averages is that if they are rising that signals an up-trending market and you should be buying the pair (the quick average is used to for the short term while the slow for the long-term) and if they are declining you should sell the pair.

The second, and more advanced, way is to analyze the alignment of the two averages. A buy signal (called Bullish signal) is given when the quick average crosses above the slow one and conversely a sell (or Bearish) signal is when it crosses below it. There are annotated examples for both of these signals for better understanding.

Breakouts and consolidations

Trading breakouts from consolidation patterns are one of the most reliable trading strategies. A consolidation pattern is usually found after a strong move when the market ‘digests’ the move and gets ready for the next trend.

There are numerous patterns like this, and they are named after something they resemble. On our example chart, there are two annotated patterns a ‘Triangle’ and a ‘Flag’ consolidation pattern. Both are good formations—when the price leaves the patterns on the positive or negative side (called a Breakout) it usually signals a strong move in that direction.

As a general rule, you should get familiar with only a few patterns at once. In fact, a lot of successful traders only trade one pattern that they know the best. If you practice, you will get a feel for the pattern; you will know intuitively that a breakout will be tradable or not!

With these simple strategies, you can start trading and practice the basics!

Let’s see how to manage exactly your positions!

Risk and management

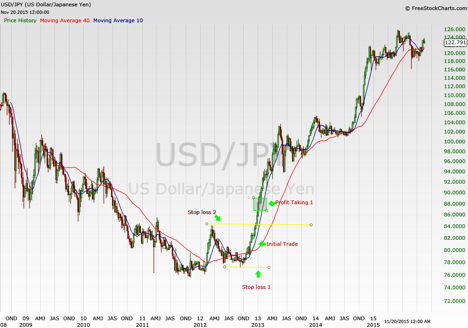

Stop-loss

One of the key principles of trading is that you should always limit your losses and let your profitable positions run. When you enter a trade, you should have a plan in place how to exit that position. If your position reaches a pre-defined amount of loss, you should exit the position.

This is called the stop-loss order, and it is the basis of risk management in forex trading. The good thing is that this process can be done automatically by your broker at the time you initially trade. You just have to decide where to place the stop-loss order.

Profit-taking

When you have a profitable trade, you should also manage that position. If the currency pair reaches a sensible profit target, usually based on technical analysis, the best thing is to cash-in on at least some of the profits. If the price is in a good trend, you can leave a portion of your position open and place a new stop-loss order higher than the original one.

If you take a look at the example below it will be very easy to understand the concept. And you’re your position goes further into positive you can always follow it with a new stop loss—protecting your profits.

Remember investing? By using these simple rules, you can turn a trading position into a long-term investment—a strong trend can last for years in the forex market.

Money management

Now you know the basics of risk management, but you might ask the question: How big positions should I take?

There is no one good answer to that question; the crucial thing is that it should be in line with your trading style. Some people like to concentrate on one pair while others might have positions in several different pairs.

The important thing is that your overall risk should be controlled. If you have just one position, it may be much bigger than the multiple positions of someone else.

This process of adjusting your position sizing to your amount of capital is called Money Management, and this is maybe the most common difference between successful and losing traders. Why? Because if you don’t manage your positions one trade can ruin months of profitable investments!

Always plan your trades and manage risk!

Choosing a forex broker

To trade, you will have to open an account at an online forex broker who has access to the market. There are hundreds of brokers out there so you should wisely. There are many factors to consider; here is a list of the most crucial ones:

Reputation, history of the company

If you will trust a broker with your money you should be sure that the firm you deal with is a reputable and reliable one. Check the history of broker the longer it dates back, the better as they have probably lived through difficult markets and proved stable. You should also check the reviews left by previous users, current users, and independent third parties about the services of the broker. A simple Google search would yield tons of resources on Forex broker reviews, stockbroker reviews, and binary options reviews among others

Retail brokers and ECNs

Retail brokers need an intermediary to reach the markets; they are usually (but not always) smaller companies and the cost of trading is higher than with ECNs. There are a lot of retail brokers as it is relatively easy to set up one. You can find great retail companies, but some of them are unreliable so before you open an account do a little research.

ECNs have their market centers with direct access provided to costumers. This means quicker, more reliable trading even in complex market situations like in the case of a major economic data release. ECNs are more stable companies in general but opening an account might be a bit difficult, with higher minimum account sizes and more sophisticated trading platforms.

Product range

Even if you only want to trade currencies there might be a huge difference between brokers in choices they provide. Whether or not this is an issue for you will depend on your preferences.

Do you want to trade only significant pairs (EUR/USD, USD/JPY, GPB/USD/, EUR/GBP, EUR/JPY, etc.) or do you prefer to have more exotic currencies as well? Maybe precious metals? Or popular stocks? There are companies that offer all of those products just be sure to check before you decide.

You can opt for a non-specialist broker too. These brokers don’t only concentrate on forex—it is just one part of their product range. That might mean a steeper learning curve concerning their platforms but will provide a lot of options if you ever want to expand your investment scope (bonds, stocks, commodities, options, etc.).

Spreads, Commissions, Margin rates and other fees

The costs of an account may seem minor but in the long run, they add up considerably. Even small differences can mean thousands of dollars after a few years of trading.

If you trade actively, maybe dozens of times a day, the trading costs are the most important for you. Those are the spreads for the different pairs (might be fix or variable) and the trading commissions if there are any.

For a trader who has longer positions, the flat fees for an account and margin rates are the deal-breakers. Margin rates are simply put the costs of holding positions for more than one day.

Be aware—there are huge gaps between brokers in this!

Trading Platform

The interface where you will trade is always a crucial factor. The easiest way to test if you feel comfortable with them or not is to open Demo Accounts by the best brokers you’ve previously selected.

This is also an excellent opportunity to get to know trading and test your first strategies. You can get familiar with chart patterns and trend analysis without risking your capital.

The most common platform is the Meta Trader (MT)—you should probably start with a broker that offers that as a platform. It is easy to use (and there are great guides for helping you learn it), and you will be able to trade with most of the brokers using MT.

Staying ahead of the markets

Now that you know how to choose a broker and start exploring trading strategies on a demo account, there is one more piece of advice to get you going: keep your knowledge up to date by reading dedicated news sites, following economic releases, and educating yourself about different strategies.

It’s a fascinating world with many opportunities and challenges. As you learn more about the market your results will get better and more consistent—you should never stop evolving as a trader!

Good luck trading!

Share the post "How to be a Successful Forex Trader?"