Is the Financial System One Giant Pyramid Scheme?

FOUNDATION

Now that we’ve explored how average financial schemes scam people, it’s about time we investigate our present financial system to see how it scams people in a positively above-average way. To do this, we first need to explore the system’s innards, i.e. shed light on how money is created, how it’s manipulated, and how you and I and all of society are bound inside its cage.

To begin, let’s show how money is created.

*The new money created is created out of debt, i.e. the Central Bank created the 10 billion with the expectation that it will all be paid back. So essentially, MONEY = DEBT. [In fact, under our current system, one cannot exist without the other. If everyone paid off all their debt, there would be no money for the economy to function. The crazy thing is, the world doesn’t even have enough money to pay off all the debt that exists (sidebar B will answer why this is so).]

*Once the 10 billion is deposited into a bank, that bank can then lend out that money. The only limit being said bank needs to keep a percentage of the original deposit on hold as a “reserve” (usually around 10%); e.g. out of the 10 billion deposited, the bank can now lend out 9 billion. [This process is referred to as “Fractional Reserve Banking.”]

*However, while logic would have you think that banks lend out that 9 billion from the original 10 billion, the truth is that 9 billion is lent ON TOP of that original 10 billion. That’s right, 9 billion in brand new money is created into the economy simply because there is a demand for this loan and there is enough money in the bank to fulfil the reserve requirements. So basically, after the bank asks you for assets (e.g. your car) to back up your mortgage, the bank in turn creates and lends you money from nothing, money that’s backed up by nothing except a hypothetical liability: money that you’re expected to pay back and then some.

*The implications of this are huge, as this process will happen all over again in the bank where that 9 billion is next deposited (minus the 10% reserve) and again in the next bank and the next, etc.

*If this process runs its course, that initial 10 billion the Federal government called into existence has the potential to add another 90 billion into the economic system. All of this is money created out of nothing.

*But if the money came from nothing, where does it get its value? The only place it can: from the existing money supply. The new money steals value from the existing money supply, expanding the money supply irrespective of the demand, thus reducing its worth and creating inflation. This means that our Fractional Reserve System is inherently inflationary, thus reducing the buying power of our money (see chart below).

*This inflation acts as a built in tax upon society and is a built in trait of our financial system.

Now that we know how money is created, let’s take it one step further. Aside from the inflation that’s structurally built into our financial system (thanks to the Fractional Reserve System), there is another factor, one that makes this system thoroughly unstable and perpetually in need of government intervention—like a crack fiend’s constant search for another fix.

Interest.

Sometimes called usury, interest (the charging of a fee for the use of money) was once banned in the ancient world. All Abrahamic belief systems (i.e. Judaism, Christianity & Islam) likened it to a sin and even philosophical titans like Aristotle deemed it unnatural. It was only until late into the 16th century that interest slowly began to gain acceptance (primarily due to a push from the business classes), until charging interest became normalized in the 17th century.

Now while the concerns about interest being sinful may be a tad antiquated, the way it affects and distorts our financial system, our personal lives and our freedoms are very real.

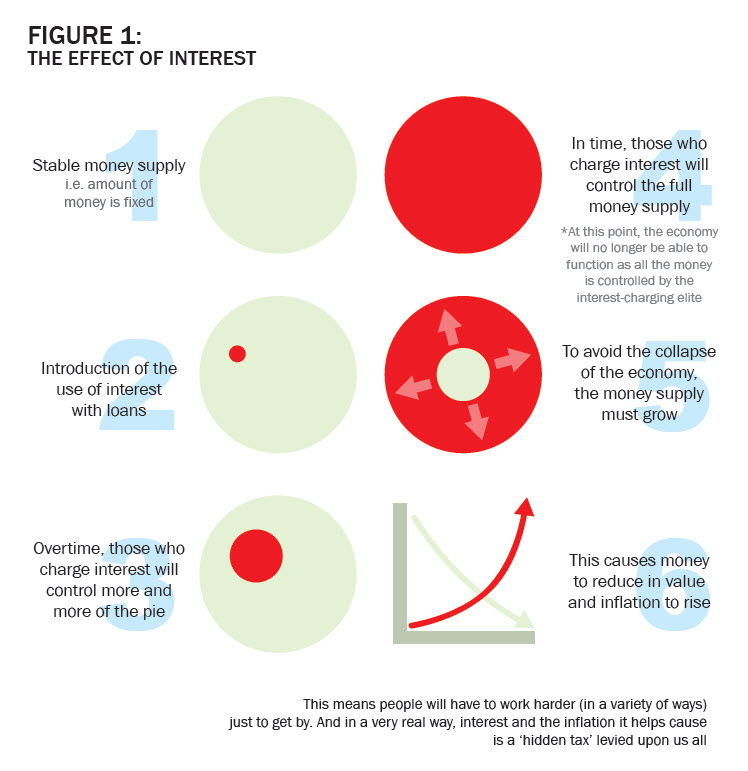

To explain, think back to the previous sidebar that explained how money is created and now add on top of it the next sidebar that explains the effect of interest.

From what The Effect of Interest infographic* shows us, interest has no place in a perfectly stable and sustainable monetary system, as its presence is an inherently destabilizing influence that works to undermine the viability of a stable economic system.

This is because not only is new money generated out of nothing (ala sidebar A), but the money needed to pay back the interest applied to this new money doesn’t even exist!

So where does society find all this non-existent money to pay down the interest on the money that was created out of nothing?

It can’t.

The system in place now has a built-in perpetual deficit, one that is destined to collapse the entire system unless measures are taken to avoid it.

As luck would have it though, there are two options to deal with this flaw. Individually, those who don’t have the power to print more money and can’t pay their debts or interest can simply go bankrupt and have their assets liquidated. Meanwhile, governments, which can print more money, do so, and do so excessively (as we saw governments do following the late 2008 Housing Meltdown).

Thus, on a micro level, the ill effect of both fractional-reserve banking and interest is that a percentage of the population is destined for financial disaster. Meanwhile, on a macro level, the expansion of the money supply, leads to a reduction in buying power (i.e. structurally built-in inflation) and as already mentioned, a hidden and ever-growing tax upon all society in the form of inflation.

Share the post "Is the Financial System One Giant Pyramid Scheme?"